Audit of Expenses

Expenses are a high-risk area for any company when comes in terms of accounting and chances of fetching quality observations are quite high as compared to other accounting processes.

A financial audit is a chance for the business to double-check books for accuracy and proper documentation of expenses.

When reviewing company expenses, auditors evaluate expenditures to make sure they were necessary and in line with internal policies. Expenses can be anything like the company paid money for in return for income – rent, invoiced expenses like the cost of supplies and reimbursable expenses such as travel charges incurred by an employee.

In carrying out an audit of expenses, the auditor is particularly concerned with obtaining enough appropriate audit evidences to corroborate the management’s assertions regarding occurrence, completeness, measurement, presentation and disclosure.

The following features of expenses affects the nature, timing and extent of the related audit procedures:

(a) In most of the cases of expenses items, documentary evidence originating from third parties are available.

(b) The nature and relative significance of various items of expenses usually differ from one enterprise to another, depending primarily on the nature of operations carried out by them.

(c) The amount of some items of expenses (e.g., gratuity, taxes, bonus, etc.) is significantly affected by applicable laws.

Let us discuss some relevant audit procedures as per ICAI Guidance Note which includes illustrative audit procedures that might be adopted by the auditors in auditing various items of expenses.

Reasonableness of Expenses Check

A reasonableness check involves checking expenses to see if they are in line with what is considered ordinary. For example, an invoice of INR 2,000 for a small box of pencil would not be reasonable and should raise a red flag. An additional reasonableness step is to make sure that only expenses that are necessary are incurred. Having a bill from two electricity companies for one location should also cause an audit flag, as most locations only have one electricity supplier.

Vendor Legitimacy Verification

A final check is to ensure that all vendors exist and are real businesses. One of the ways fraudulent transactions occur is for an employee to set up a nonexistent vendor and submit made-up bills.

Verification by auditor

Expenses verification may be carried out by employing the procedures, viz., (a) examination of records; and (b) analytical procedures. The nature, timing and extent of substantive procedures to be performed is, however, a matter of professional judgment of the auditor which is based, inter alia, on the auditor’s evaluation of the effectiveness of the related internal controls. The auditor should examine whether the basis of recognition of expenses by the entity is in accordance with the recognized accounting principles.

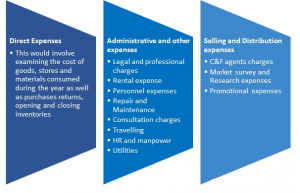

High-risk Expenses in a company may be categorized as below:

An auditor must verify the following Four Potential Errors as to:

- Completeness – that transaction is not recorded

- Recording – that transaction is recorded inaccurately

- Cut off – that transaction is recorded in accounts in the wrong period

- Validity – that the recorded transaction is not valid

He shall follow below procedures for carrying out audit of major expenses covered by the business unit:

- Check the nature of agreement and obtain assurance as to the reasonableness of the amount charged.

- Verify whether the necessary documents or supporting vouchers are attached with the expenses.

- Whether company is having documented list of Authorized personnel who sanction expenses & their individual amount of sanctioning the limits.

- Check whether the expense incurred is of revenue nature which should be properly accounted for & ensure that no capital expenditure has been made.

- Verify whether the TDS has been properly deducted wherever applicable.

- Verify the Cut off entries to ensure that all the expenses are properly recorded in the current financial period.

- Check that all expenses claimed are solely related to business and no personal expenses have been included.

- Verify that necessary provisions are made during the closing of accounts & ensure those are correct.

- Understand the provision policy of the company for Operating expenses. Normally the provisions are based on actual & estimated basis

- Apply the “Analytical Testing” method for verifying the expenses & based on that derived the expected figures & compare with the actual figures recorded in the financial statement.

- Verify if any “Related Party” transaction made during the year & ensure that are presented in the financial statement.

- Ensure that Operating expenses balances are reasonably stated in the financial statement.

To sum, expense auditing is a fundamental risk management task that’s often critical to a company’s profitability. Because expenses reduce revenue, basic audit procedures help preserve the bottom line, particularly when processing expense reports, which is a common task for bookkeepers and accountants. For a firm with a large sales force, for example, close monitoring of claimed expenses against company rules and standards ensures that funds aren’t lost to inappropriate spending. The same principle applies to any amount a company spends in the regular course of business. The systemic review of expense amount, sources and suitability are central to fiscal responsibility for any organization.