General Financial Rules (GFR Rules)

The General Financial Rules (GFRs) are the general rules of Government of India (GOI) which are applicable to all Government Ministries/Departments. Exceptions are provided in the Rules. These rules are applicable in matters relating to Public Finance, that is, Matters relating to Revenue and Expenditure of Government.

These rules were first introduced in 1947 and modified thereafter in 1963, 2005 and 2017. A task force was established for comprehensive discussion and review of the GFRs set up. GFR sincludes all effects of Reforms introduced by the Government, for example, Direct Benefit Schemes (DBS), merger of Railway Budget with the General Budget, Introduction of Government e-Marketing Portal, Non-Tax Revenue Portal, etc.

These Reforms were introduced due to the changing Business Environment to promote simplicity and transparency in the Government Financial System and procedures.

The various important Rules are further explained as under:

General Principles Relating to Expenditure and Payment of Money

- In case any expenditure is incurred by any officer, then the following should be observed:

- Vigilance:Every public officer is expected to exercise the same vigilance in respect of expenditure incurred from public moneys as a person of ordinary prudence would exercise in respect of expenditure of his own money and expenditure should not be more than situation demands.

Public Interest:Any authority which is benefiting themselves directly or indirectly from the expenditure should not sanction the expenditure by itself, the expenditure shall not be made for particular person or community unless no special orders received in this regards and it should be in public interest.

- The Duties and responsibilities of a Controlling officer is to ensure,

- That the expenditure does not exceed Budget,

- That incurred only for the funds provided,

- That incurred in public interest,

- That adequate controls are there in the department for prevention of wastage of public money and

- Errors prevention and detection

- In case of certain special matters like, relinquishment of revenue; rights of power, water; grant of land etc. unless the power to issue an order is delegated or approved by the President, a subordinate authority cannot issue an order without the previous order of the Finance Ministry.

- A sanction for any fresh charge shall lapse if it is not renewed and if no payment has been made during a period of twelve months from the date of issue of sanction, provided that,

- When the period of sanction is prescribed in the regulations, then on the expiry of such period

- When the regulations say that the expenditure would be met from the Budget provisions, then at the end of the Financial Year

In case of purchase, the sanction won’t lapse if any tender has been accepted within the period of one year, even if no payment, in whole or in part has been made.

- Notwithstanding anything contained above, any sanction related to addition to a permanent establishment, made from year to year under a general scheme by a competent authority, or an allowance sanctioned for class(s) of government servants, but not drawn by the officer(s) concerned, shall not lapse.

- The Reserve Bank of India (RBI) shall be the Banker to the Government. It shall provide various banking services to the Ministries either through its branches or its agent banks. All payments and all receipts (including tax revenues) shall be made or collected by the RBI through its own offices or through the nominated branches of its agent banks.

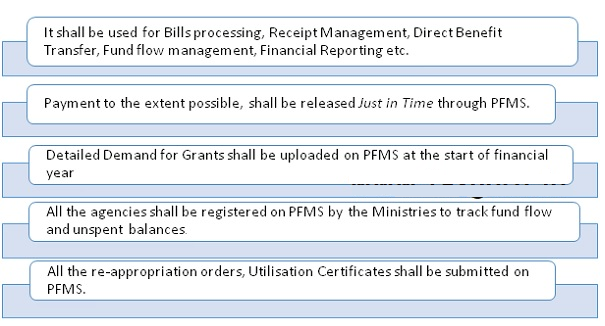

Public Financial Management System (PFMS)

PFMS is an integrated Financial Management System of Controller General of Accounts.

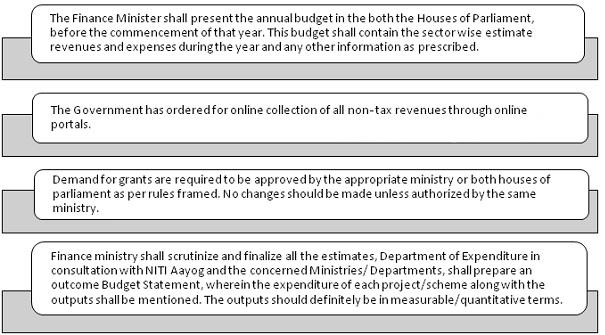

Budget Formulation and Implementation

Control of Expenditure Against Budget

To maintain the control of expenditure over sanctioned grants, the CG should follow an effective control as follows:-

- Bills with proper classification of account should be presented for withdrawal of money.

- All the drawing officers shall maintain registers in Form GFR-5, physically or electronically, for allocation under each minor Head and submit it with the head of the department on the third day of following month. A register shall be submitted irrespective of nil statement or if there are any adjustments like, inward claims.

- A broadsheet of all the receipts shall be maintained in Form GFR-6. The Controlling officer shall ensure that classifications are done properly, expenditure is less than the Grant amount, reason of the increased expenditure shall be properly noted and it is properly signed by the Disbursing officers

- When all the verification is done, the Controlling Officer shall prepare a Statement in Form GFR-7, wherein the Totals from GFR-5, Statement Totals given by the Disbursing Officers and other Total of Adjustments which have not been taken before, should be incorporated. These new adjustments shall also be communicated to the Disbursing Officer.

- The Head of Department shall prepare a consolidated Statement in GFR-8 in which the complete expenditure with its appropriation into various heads shall be mentioned.

- The Head of Department and the Accounts officer shall reconcile the balances maintained by both of them.

- The Disbursing Officer shall maintain a register in Form TR 28-A in which all the Bills presented to the Principal Accounts Officer shall be entered. The Bills should match with the cheques. All the retrenchments shall also be noted in the register.

- The Accounts Officer shall furnish an extract of the expenditure registers to the Disbursing Officers, in which monthly expenditure apportioned into various heads shall be mentioned. The Disbursing Officer shall tally this expenditure with the expenditure in Form GFR-5 and investigate the differences, if any. The book adjustments from the monthly statements shall also furnished in Form GFR-5. After all this is done, the Disbursing officer shall give a confirmation of the figures.

- The Principal Accounts Officer of each Department shall send a monthly statement showing the expenditure in various heads according to the Budget provisions to the Heads of Departments. They shall discuss over the differences between the Statement and GFR-8 and furnish a quarterly report on 15th of second following month after the end of quarters.

- The Heads of Departments shall prepare a statement wherein all the revenue and capital expenditure figures are entered separately by 15th of the following month. The figures shall be taken from Form GFR-8 and these figures should also be posted in other expenditure registers. The Heads of Departments shall also furnish a progress report of all schemes for which they are responsible. The physical progress, Budget provisions as well the reasons for shortfall shall also be reported therein.

- A broadsheet in Form GFR-9 shall also be maintained by the Heads of Departments wherein the prompt receipt of various returns and actions for any defaults should be mentioned.

- The Controlling officer shall maintain liability registers in Form GFR-3 from the liability statements obtained from spending authorities in Form GFR-3A every month starting from October in each financial year.

- The Department of Central Government shall provide the Finance Ministry a detail of savings noticed in the Grants by them. After the acceptance, these funds shall stand lapse at the end of the financial year. These funds shall be returned to the Government.

- No expenditure on a New Service shall be made which is not provided in the Annual Budget, unless there is a supplementary Grant for it.

- The Disbursing officer shall not approve an excess allotment of an expenditure unless he has taken approval from his superior authority. The authorities shall also maintain these excess allotments in the liability register in the Form GFR-3.

- In case of re-appropriation of expenditure from one primary unit to another within a Grant amount, shall be furnished in Form GFR-1.Re- appropriation shall only be made when it is known or anticipated that units from which the funds are to be transferred are not to be utilised in full or savings can be affected in them. Also proper approval from competent authority should be taken.

- In case any need for an unforeseen expenditure for a New Service not provided in the Budget arises and there is no time for voting of the Supplementary Demand, then an advance from the Contingency Fund, set up under Article 267(1) of the Constitution shall be obtained before incurring the expenditure. The procedure for obtaining an advance is laid in the Contingency Fund of India, 1952.

- The Secretary of a Ministry/ Department, who is the Chief Accounting Authority shall be responsible for all the financial matters of his ministry (including control on expenditure, accounting and appropriation, receipts and collection of funds, appearance to parliamentary committee and to his ministry as required)

Defalcation and Losses

- Any loss or shortage of public money, revenue, receipts, or other property held by or behalf of government, shall be immediately reported to the next higher authority, Statutory Audit Officer, and Principal Accounts Officer even if such loss has been made good by the party responsible. However, the following losses need not to be reported:

- Losses due to mistakes in assessments which are discovered too late,

- Assessments due to interpretation of law by the local authority overruled by the higher authority

- Losses not exceeding Rupees ten thousand

- Cases involving serious irregularities should be reported to Financial Adviser or Chief Accounting Officer of the Ministry or Department and the Controller General of Accounts of Ministry of Finance. A Report of loss should be maintained containing

- An initial report, which should be made as soon as the suspicion arises

- The final report, to be sent to higher authorities

- All losses more than Rupees Fifty thousand due to suspected fire, fraud or theft of Government property, shall be reported to Police for investigation as early as possible, similarly all losses of immovable property of more than Rupees Fifty thousand, such as building, due to cyclone, earthquake, fire, flood etc. shall be reported at once by the subordinate authority.