Internal controls and Audit of Fixed Assets

Fixed assets, in an organization represent the long-term tangible assets which are used,

-to produce and deliver its products or services, and

-to manage its operations.

They are assets held for the purpose of providing or producing goods or services and are not meant for sale in the normal course of business. Therefore, an asset can be classified as a fixed asset or otherwise, depending upon the use to which it is put or intended to be put.

In many capital-intensive industries such as manufacturing, power generation and healthcare, fixed assets represent the largest item on the balance sheet. Historically, fixed assets have received little audit scrutiny and, as a result, some major financial frauds have been perpetrated through significant misstatements of fixed asset balances in the financial statements of public companies.

When asked if fixed assets are represented accurately in year-end financial statements, most organizations will answer with “yes.” However, audits may yield a different answer. Although many organizations do not perform an inventory of current fixed assets and a corresponding reconciliation, these steps provide an essential internal control for the financial reporting of fixed assets.

Moreover, fixed assets need attention to ensure the organization’s records are accurate and its controls provide effective oversight of this area. As with other asset classes, best practices enhance proper accounting, valuations and financial reporting.

Internal Controls over Fixed Assets

Fixed-asset transactions typically represent the acquisition and disposal of assets and the allocation of related costs to reporting periods through depreciation expense. The internal controls over the acquisition of fixed assets include the following:

- Issuance and approval of a purchase order

- Receipt of assets and preparation of a receiving report

- Receipt of an invoice from a vendor

- Reconciliation of the vendor invoice to the related receiving report and purchase order

- Authorization of the payment of the vendor invoice

- Issuance of a check for payment of the vendor invoice

- Posting of the entry in the equipment sub-ledger

- Posting of the equipment sub-ledger activity to the related general ledger control accounts

- Reconciliation of the general ledger control accounts

Audit of Fixed Assets

External Auditors of most manufacturing organizations usually scope in Property, Plant & Equipment (PPE) as a risk area during their annual audit due to its materiality. A combination of controls testing and substantive testing is usually adopted when obtaining audit assurance on PPE.

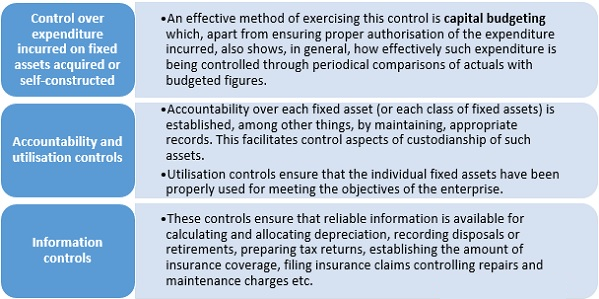

An auditor should review the system of internal controls relating to fixed assets, particularly the following:

Verification under audit

Verification of fixed assets consists of examination of related records and physical verification. The auditor should normally verify the records with reference to the documentary evidence and by evaluation of internal controls. Physical verification of fixed assets is primarily the responsibility of the management.

Verification of Records

- The opening balances of the existing fixed assets should be verified from records such as the schedule of fixed assets, ledger or register balances.

- Acquisition of new fixed assets and improvements in the existing ones should be verified with reference to supporting documents such as orders, invoices, receiving reports and title deeds.

- Self-constructed fixed assets, improvements and capital work-in-progress should be verified with reference to the supporting documents such as contractors’ bills, work-order records and independent confirmation of the work performed.

- The auditor should scrutinize expense accounts (e.g. Repairs and Renewals) to ascertain that new capital assets and improvements have not been included therein.

- Where fixed assets have been written-off or fully depreciated in the year of acquisition/ construction, the auditor should examine whether these were recorded in the fixed assets register before being written-off or depreciated.

- In respect of fixed assets retired, i.e., destroyed, scrapped or sold, the auditor should examine

(a) whether the retirements have been properly authorized and appropriate procedures for invitation of quotations have been followed wherever applicable;

(b) whether the assets and depreciation accounts have been properly adjusted;

(c) whether the sale proceeds, if any, have been fully accounted for; and

(d) whether the resulting gains or losses, if material, have been properly adjusted and disclosed in the Profit and Loss Account.

It is possible that certain assets which were destroyed, scrapped or sold during the year have not been recorded. The auditor may use the following procedures to ascertain such omissions:

- Review work orders/physical verification reports to trace any indicated retirements.

- Examine major additions to ascertain whether they represent additional facilities or replacement of old assets, which may have been retired.

- Make enquiries of key management and supervisory personnel.

- Obtain a certificate from a senior official and/or departmental managers that all assets scrapped, destroyed or sold have been recorded in the books.

- The ownership of assets, like land and buildings should be verified by examining title deeds. In case, the title deeds are held by other persons, such as solicitors or bankers, confirmation should be obtained directly by the auditors through a request signed by the client.

Concluding Remarks

In order to help the auditors undertake quality audits and adhere to the audit compliance standards, ICAI has released guidelines advising auditors with regards to conditions that may arise due to COVID-19 pandemic, how they can carefully examine specific circumstances while undertaking audit and assess the risk accordingly. For auditors, it is majorly “remote” auditing, going through virtual data, but continuing to comply with the requirements of standards on auditing.

The COVID-19 outbreak may affect the useful life and residual life of fixed assets which requires management review. In case the expectations differ from previous estimates, then change in estimate should be accounted for in accordance with Ind AS 8, Accounting Policies, Changes in Accounting Estimates and Errors.

It is imperative to ensure that appropriate level of disclosures are done in the financial statements (which in most cases is a judgment call, depending on the facts and circumstances of each case) for the users of the financial statements to understand the impact of pandemic on the company as assessed by the management, Board of Directors and Audit committees.