TCS under Income Tax – provisions applicable from 01.10.2020

Tax Collected at Source Under Income Tax – New Provisions Applicable from 01 October 2020

Introduction

Finance Act, 2020 introduced 3 new provision under Tax Collected at Source (“TCS”):

TCS on foreign remittance through LRS;

TCS on selling overseas tour packages; and

TCS on sales of any goods

TCS unlike TDS is required to be collected additionally along with consideration for certain transaction;

That is TCS is required to be collected by the payee;

Whereas, TDS is required to be deducted on certain payments made by the payer for certain transactions.

TCS ON FOREIGN REMITTANCE THROUGH LRS

The new provisions of tax collected at source are applicable w.e.f 01 October 2020

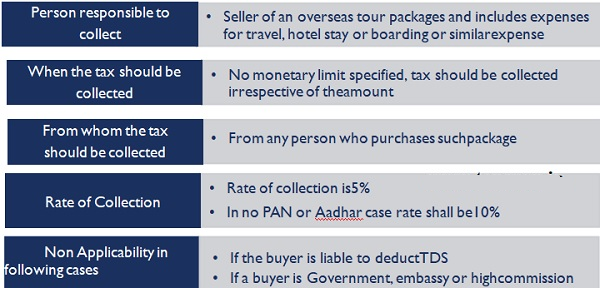

TCS ON SELLING OVERSEAS TOUR PACKAGES

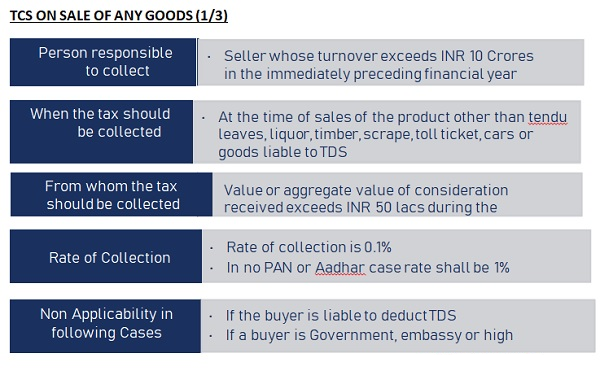

TCS ON SALE OF ANY GOODS (1/3)

TCS ON SALE OF ANY GOODS(2/3)

TCS ON SALE OF ANY GOODS(3/3)

We have tried to address few practical aspects in implementation of the said provision by way of FAQs:

| How to Collect Tax from the buyer? | The seller needs to raise the invoice inclusive of the amount of TCS. However, liability of remittance does not arise until the time when amount is to be collected |

| How to determine the applicability of these provision? | The law does not make mandatory to comply continuously once the seller is obliged to follow, which means the applicability needs to be determined on a year to year basis |

| Whether TCS applicable on sale of property? | Sale of property is covered distinctively under the provision of section 194IA for value exceeding INR 50 Lakhs |

| Whether TCS should be refunded in case of sales returns? | No, only primary sales value should be refunded as the amount of TCS would have been credited as prepaid taxes and will appear in Form 26AS of the buyer. However, if the amount has not been settled or net settlement is being made post adjustment of return then on such net consideration TCS should be collected |

| Whether the consideration will include the amount collected towards GST? | The word consideration is not defined. In terms of section 145A irrespective of the treatment in books of accounts, the value of sales will be inclusive of GST |

TCS PAYMENT AND RETURN

- TCS collected needs to be paid within 7 days of the nextmonth.

- Every tax collector shall submit quarterly TCS return i.e., Form 27EQ in respect of the tax collected by him in a particular

- The due date of quarterly return is asunder

WAY FORWARD AND SCOPE LIMITATION

| WAY FORWARD | SCOPE LIMITATION |

| We shall assist in determining the applicability of the above provision, depending on the nature of business and each business transaction;and | We have not considered the current revised rates as proposed by the government in view of the global pandemic COVID – 19;and |

| The amount on which the tax should be collected and the amount of remittance for each of the transaction. | However, for the sake of the completion, the rates w.r.t sale of goods have been reduced to 0.075% for buyer having PAN/Aadhar, for current financial year only |

Disclaimer

Please note that the above note is subject to government clarification or changes in law, we have merely discussed the applicability in the current scenario